Health Insurance Enrollment and Cost of Care Assistance

OVERVIEW

GLFHC’s Outreach and Enrollment Team focuses on supporting patients with enrolling in health insurance and ensuring that all individuals have access to affordable, comprehensive healthcare coverage. We provide individuals with the resources and support needed to understand their options and guiding them through the application process.

Worried about the cost of care? We can help.

MASSACHUSETTS

HEALTH CONNECTOR

Income limits have changed and now more people qualify for low-cost health insurance.

Click this box to check your eligibility and receive an estimate.

MASSHEALTH MEMBERS

You need to renew your coverage every year. If you need help completing your renewal form, you may schedule a phone or video appointment with a MassHealth representative using their online scheduling tool.

Click this box to book an appointment.

NEW PATIENT INFORMATION

Welcome to GLFHC!

Click here for a welcome packet.

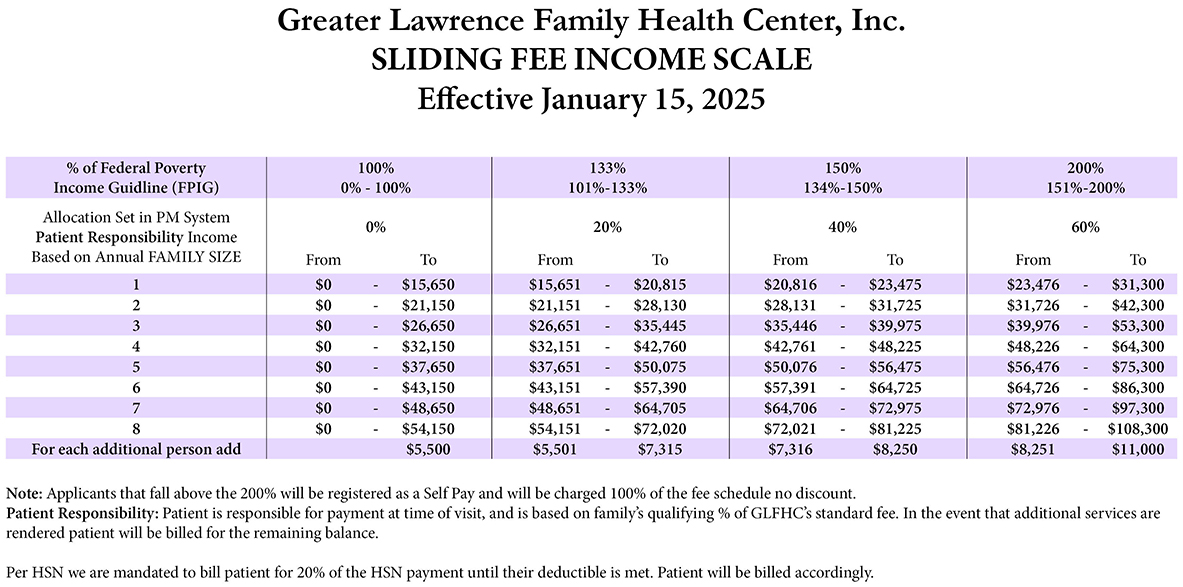

Sliding Fee Income Scale

GLFHC’s Sliding Fee Income Scale will help make payments affordable, based on your income.

If you have any questions about the cost of care, applying for free or reduced-cost care, or whether the health center accepts your health insurance, please contact an Insurance Certified Application Counselor.

MassHealth Certified Application Counselor

Get the right plan for you and your family. Our Insurance Certified Application Counselors can help.

To apply for health insurance coverage, speak with an insurance counselor before your visit with your medical provider. An insurance counselor can help you with the application process and determine your eligibility for affordable health insurance plans.

You don’t need to be a patient to speak with one of our Insurance Certified Application Counselors. This is a free service available to anyone by calling 978-686-0090.

You may qualify for health coverage regardless of your immigration status.

Our Team is available to support you with:

- MassHealth New and Renewal Applications

- Reporting changes to MassHealth and Health Connector

- (Demographics, Family size, Adding or Removing Members, Serious Health Conditions, Reporting pregnancy, Marital Status, Immigration Status, Income)

- MassHealth Health Plan Enrollment

- Health Connector Health Plan Enrollment

- Medicare Health Plan Enrollment (SHINE Services)

- All Health Plan Disenrollment

- Health Plan Primary Care Assignment

- Education on your Health Plan Benefits.

If you have any questions about the cost of care, applying for free or reduced-cost care, or whether the health center accepts your health insurance, please contact an Insurance Certified Application Counselor.

You will need to bring the following information with you when you meet with an Insurance Counselor for all members applying.

Under 65 years of age:

- Photo ID (driver’s license, passport etc.)

- Proof of income (Latest two weekly pay stubs or one bi-weekly pay stub, income tax forms)

- Proof of Immigration Status (legal permanent resident card, visa, asylum, etc.)

- Proof of Citizenship (a photo ID along with a birth certificate or a passport)

- Proof of Social Security Card

- Proof of Address (Electricity or gas bill)

Over 65 years of age:

- Photo ID (driver’s license, passport etc.)

- Proof of income (Latest two weekly pay stubs or one bi-weekly pay stub, income tax forms)

- Proof of Immigration Status (legal permanent resident card, visa, asylum, etc.)

- Proof of Citizenship (a photo ID along with a birth certificate or a passport)

- Proof of Social Security Card

- Proof of Address (Electricity or gas bill)

- Bank Statement (Current account statement within 45 days)

- Car Title/Registration (Registration for each vehicle and proof of the outstanding loan balance)

- Copies of all assets, if any (dead, current tax bill(s), and proof of amount owned on all property owned)

- Income properties

- Burial insurance (Trust contract, trust instrument, insurance policy, or burial-only account)

- Life insurance policy (Total face value of all policies exceeds $1,500 per person and insurance company letter showing the current cash-surrender value)